**We are not tax professionals and cannot answer tax specific questions. Please contact your CPA or accountant.**

It's that time of year again. Tax season Is upon us.

Sleep Sound has provided you with both a digital copy and a hard copy of your 1099-MISC form for the latest tax year.

If you have not received your hard copy yet, you should very soon (international clients do not receive a hard copy).

Accessing Your Digital Copy

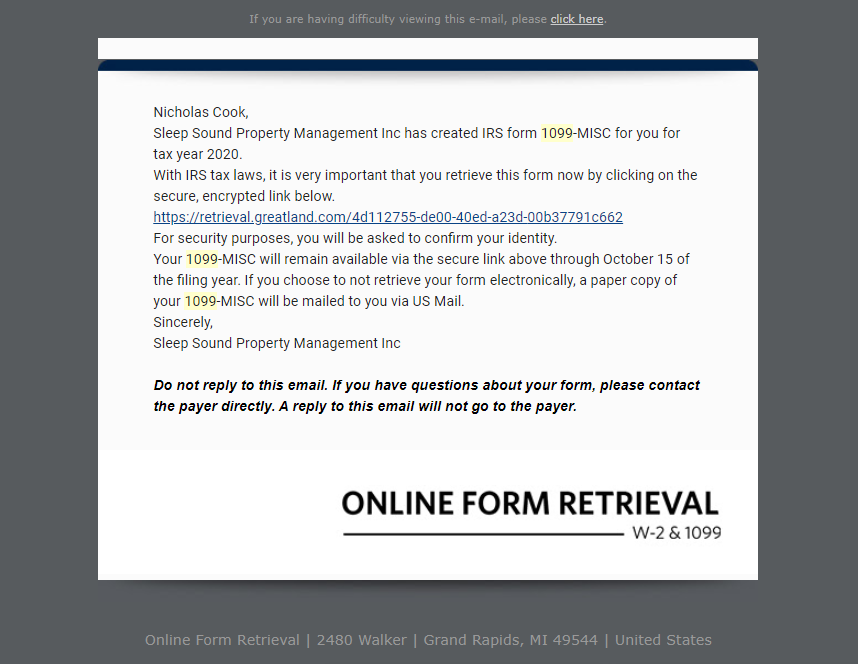

An email is sent from onlineformretrieval@mail.onlineformretrieval.com with a link to access your document.

The link will require you to enter your tax ID. This may be your SSN or EIN depending on what you provided on your W-9.

The email will look like the image below.

Year-to-Date Statements

To make things easier your Property Manager will be sending you a Year-to-Date Income and Expense statement for the most recent tax year. This will allow you to easily view any expenses processed by Sleep Sound that may offset your rental income.

FAQ's

Q: What if my year-to-date statement and my 1099-MISC do not match.

A: This should not occur, but one common reason for this is if your resident paid rent early (not a bad problem to have). Our software logs any rent payment on the date the resident pays, however, simply initiating a transaction does not mean it has been funded. We only report income that has been funded because pending transactions mean the money is not in the client trust account and therefore not available for use.

Example: Your resident pays rent on December 30, 2020 and funds actually deposit on January 2, 2021. Buildium logs the income in 2020 which is why it may appear on your year-to-date statement. Unfortunately, this is not totally accurate. To fix this we manually adjust these payments to reflect the December 30, 2020 payment as income in 2021 because that is when it was actually funded and received (think about it as a check in the mail versus a check being deposited). The same thing could have happened at the beginning of the year where income was reported on the year before, December 2019, but funded in January 2020. In this case income would be added to your 2020 report as it was not reported in 2019.

Q: What if my rental property receives 3rd party income such as Section 8 income or housing assistance from another source in addition to the tenant?

A: Great question. You will receive two 1099-MISC forms. One from Sleep Sound and the other from the 3rd party payer e.g. Home Forward, Housing Authority of Washington County, etc.

To ensure you have the most accurate information, Sleep Sound will report on your 1099-MISC form income from the resident and the 3rd party payer. Since the 3rd party will also be sending you a 1099-MISC, the income from the 3rd party will be reported twice. You will want to subtract the 1099-MISC income reported by the 3rd party payer, from the total income reported by Sleep Sound to get an accurate number.

We have opted to follow this format to prevent under reporting of your income.

For more advanced questions we encourage you to contact your CPA or accountant.