Real estate is a great investment, but it’s not as passive as people think. When you own a rental, you are still involved in the decision making process and ultimately take all the risk.

Real estate syndications are a great way to capture the benefits of real estate ownership while being truly passive.

What Are Syndications

Real estate syndications are led by a sponsor (the general partner aka GP) who finds and vets potential real estate investment opportunities.

These opportunities are then shared with investors (limited partners aka LP) who decide to invest.

Investments can be short term (2-5 years) or long term (7-10+ years).

6 Common Reasons Why Investors Like Syndications

Investors get access to opportunities they would unwise not have access to e.g. participate in the purchase of a 50, 100, or 150+ unit apartment versus a single family home or small plex.

Returns on an investment can be much higher compared to more conservative or traditional opportunities.

Major tax benefits such as accelerated depreciation to offset other income.

Passive income from recurring cash flow.

Utilize retirement accounts funds to generate returns e.g. IRA or Roth IRA’s

Limited time required and no operational expertise required.

How Do Syndications Work?

There are 2 common approaches to syndication.

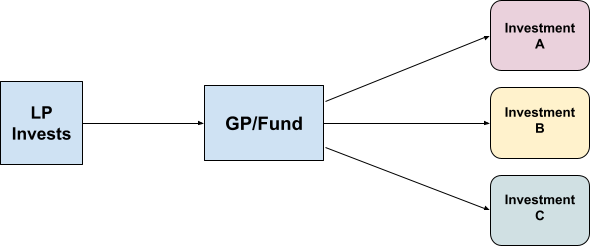

The Fund Model

This is where LP’s invest into a fund and the fund uses that cash to buy deals. Investors do not evaluate the opportunities on a case by case basis.

The Per Deal Model

investors are presented with a unique opportunity to invest in a property. Investors have a chance to vet and underwrite each opportunity and opt-in or not.

The Process

Regardless of the model, the GP/Sponsor identifies a property investment. The GP/Sponsor then enters into a contract to purchase the property and starts due diligence (inspections, etc).

During due diligence the GP/Sponsor determines if the opportunity makes sense. If it does, they will contact investors/LP’s (if not a fund model) to wire funds by a specified date e.g. prior to closing.

The property is purchased and operations begin.

Operations may involve renovating units, improving the tenant base, etc.

At a future date, usually 3-5 years from the purchase date (can be longer depending on the goal) the property will be sold or refinanced.

Depending on the terms of the deal, investors will receive;

Return of capital

Cash flow

Tax benefits

Profits from a sale or refinance.

Learn More

If you are looking for alternatives to the stock market for short or long term investing, please fill out the form below or contact us directly.

This article is for educational purposes only. It is neither an offer nor a solicitation to sell securities and has been prepared for informational purposes only and is not intended to be a complete description and should not be relied upon by the investor in any way other than to help the investor decide whether or not to request more Information.