It’s that time of year again. Income reporting time!

Before I dive into the details of your 1099-MISC form, it’s important we discuss how to make sure your 1099-MISC filing is accurate.

How to Avoid Being on the IRS WatchList

If your 1099-MISC information is outdated, you could be flagged by the IRS. Your information can be incorrect for a variety of reasons.

To avoid problems, ask yourself;

Did you move in the last year? If not, does the address on file match the address you use to file your tax return?

Did your Tax ID or EIN number change for any reason? Maybe you transferred your property to an LLC?

Did your name change?

Is the person claiming the income on their return, the same person who received the funds?

If you think any of the above situations apply to you, then you’ll want to make sure the your name, address, and TIN/EIN number used to report the income matches your current records or you could be

What Happens If Your Information Is Out of Date?

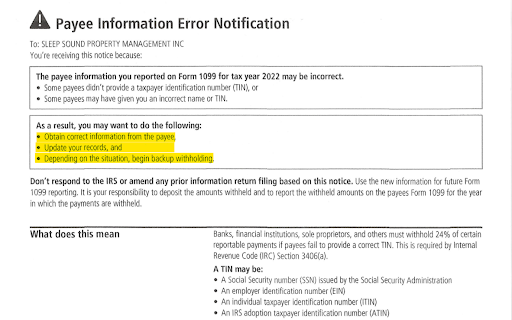

The party issuing the 1099-MISC will receive IRS Letter CP2100A. It looks like this.

Why Receiving IRS letter 2100A Letter Matters?

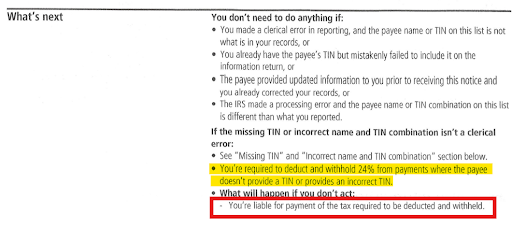

The letter instructs the payor, in this case Sleep Sound Property Management, Inc. to deduct and withhold 24% from payments where the payee does not provide a correct TIN.

This means every month 24% of your rental income would be withheld at the direction of the IRS.

You can find more information about this notice at the link below.

https://www.irs.gov/individuals/understanding-your-cp2100-or-cp2100a-notice

What is a 1099-MISC?

Form 1099-MISC reports total “gross income” earned to the IRS. This means all income the property received on your behalf. This includes, but is not limited to rent, utility income, pet rent, late fees, etc.

This means that the “gross income” reported is oftentimes different from the income you actually received throughout the year. This is because bills are paid from the income received and the remainder is distributed to you.

So how do you know what you pay tax on?

Bring your 1099-MISC along with documentation of all your expenses to your tax professional. They will factor for costs reflected in your owner statement such as repairs and expenses not reflected on your owner statement such as property taxes.

Reporting Assistance Income

Some tenants receive rent assistance. When this happens, the organization providing assistance records the property owners information and reports this to the IRS using the same 1099-MISC Form.

For this reason, the assistance income is double reported. It is reported by the assistance organization and your property manager.

The reason your property manager includes this income on the 1099-MISC even though the assistance organization reports it as well is because the IRS will penalize your property manager if they under report total income received. This could happen if the assistance organization

When Income Becomes Reportable

Sometimes tenants pay early. That means that even if the income was not distributed to you yet, it does need to be reported to the IRS.

This is another reason your 1099-MISC income may be higher or lower than what you actually received.

When You Receive Your 1099-MISC?

1099-MISC will be sent on or before January 31 each year. The goal is to make the forms available as soon as possible, but data verification and delays can lead to filings happening later in the month.

How Do I Get My 1099-MISC?

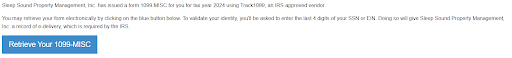

All 1099-MISC are sent digitally to the email address on file. The document is password protected with the password being your social security number or Tax ID number.

The email comes from <no-reply@track1099.com>

Below is a sample image of what the email looks like.

Conclusion

If you have any additional questions about your 1099-MISC or want to make sure your data is accurate, please contact your property manager by January 15 of the new year.